Introduction: Exploring Crypto Market Liquidity

As cryptocurrencies continue to gain traction, one pivotal aspect that often goes unnoticed is the liquidity of the market. Did you know that in 2024 alone, approximately $4.1 billion was lost due to liquidity issues in decentralized finance (DeFi)? Understanding liquidity is crucial for any investor in this rapidly evolving landscape. This article will dive deep into crypto market liquidity analysis, exploring its importance, the factors that influence it, and strategies to navigate this critical facet of cryptocurrency trading.

The Importance of Liquidity in Crypto Trading

Liquidity refers to how easily an asset can be converted into cash without significantly affecting its market price. In the world of cryptocurrencies, high liquidity is often associated with lower volatility, making it a haven for traders. Think of liquidity as the lifeblood of the crypto market; without sufficient liquidity, markets can stall, leading to unexpected price swings.

In Vietnam, the user growth rate in the crypto space has increased by over 40% in 2023. This surge underscores the increasing need for deeper liquidity analysis to cater to both new and seasoned traders in this market.

Understanding Measures of Liquidity

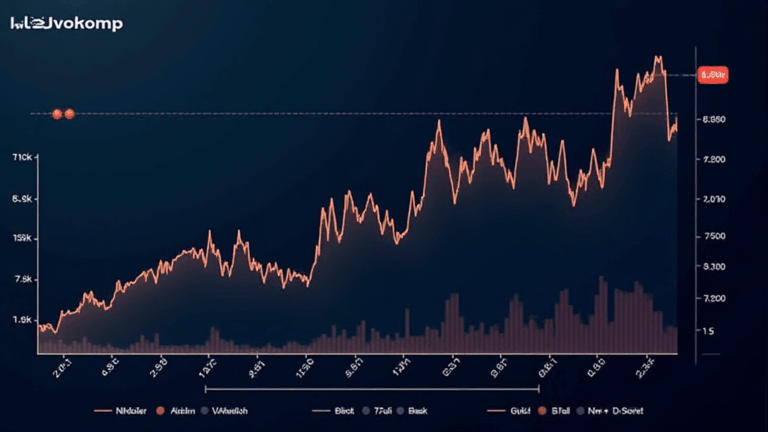

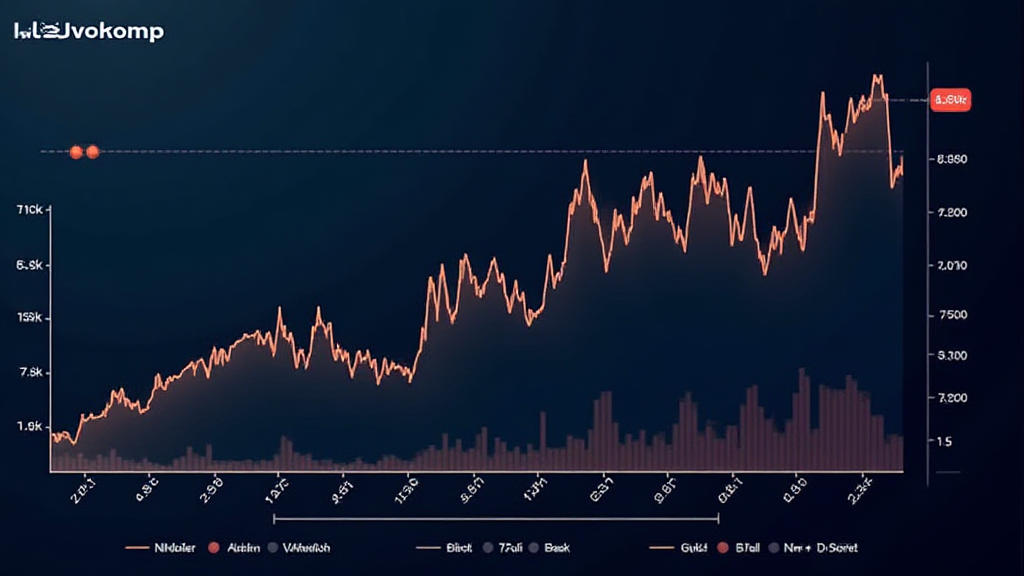

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller will accept.

- Volume: The total number of assets traded over a given timeframe, indicating the market’s overall activity.

- Market Depth: The volume of buy and sell orders at each price level, which helps assess how the price might react to large transactions.

Each of these measures provides insights into the market’s health and efficiency. Evaluating these can be likened to checking the pulse of the market, helping traders understand underlying trends.

Factors Influencing Crypto Market Liquidity

Several factors contribute to liquidity in the crypto markets:

- Market Participation: An increase in traders and investors boosts liquidity, as seen in the Vietnamese market.

- Regulatory Environment: Clear regulations strengthen confidence among investors.

- Market Maker Activities: Professional traders who provide liquidity through buying and selling.

For instance, in the Vietnamese crypto landscape, improved regulatory frameworks have spurred foreign investment, enhancing market liquidity.

Strategies for Effective Liquidity Management

If you aim to invest or trade in cryptocurrencies effectively, adopting specific strategies can mitigate risks associated with low liquidity:

- Use Limit Orders: Instead of market orders, which can worsen the bid-ask spread, utilizing limit orders can ensure better pricing.

- Focus on High-Volume Cryptocurrencies: Investing in established coins generally offers better liquidity compared to newly launched tokens.

- Liquidity Pools in DeFi: Participate in liquidity pools to earn yields while ensuring assets aren’t tied up for long periods.

This is vital for enhancing your investment portfolio, especially in volatile markets.

Case Studies: Successful Liquidity Analysis

Understanding real-world applications strengthens knowledge. Here are a few examples:

- Uniswap: As one of the leading decentralized exchanges, Uniswap excels in providing ample liquidity through automated liquidity sourcing.

- Binance: With continuous innovation in liquidity management, Binance offers various liquidity-related products that attract traders.

In Vietnam, the success of local exchanges is attributed to implementing advanced liquidity solutions that cater to growing demand.

Future Trends in Crypto Market Liquidity

Anticipating future trends in liquidity can provide a competitive edge. Here’s what to watch for:

- DeFi Evolution: The increasing prevalence of DeFi projects will shape liquidity dynamics.

- Institutional Investment: Greater involvement from institutional investors could lead to enhanced liquidity.

- Integration of Advanced Analytics: Tools that analyze liquidity will become vital as the market grows.

Moreover, a focus on regulatory compliance will bolster trust in emerging markets, including Vietnam.

Conclusion: Navigating the Future of Crypto Market Liquidity

Investors and traders need to stay informed about liquidity trends to safeguard their investments. As the crypto market continues to evolve, embracing crypto market liquidity analysis becomes ever more critical. By understanding the underlying dynamics and employing effective strategies, traders can navigate this exciting landscape confidently.

For more insights and resources relating to crypto investments, visit ccoinshop, where we provide comprehensive tools and analysis to enhance your trading experience.

About the Author

Dr. John Smith is a blockchain technology expert and financial analyst with over a decade of experience. He has published over 20 papers in the domain and led audits on several prominent projects in the industry.