Tokenomics Analysis for Investors: Understanding the Core Components

In recent years, investments in cryptocurrencies and digital assets have surged, with a staggering

$4.1 billion lost to DeFi hacks in 2024 alone. This staggering loss raises an important question:

How can investors navigate this evolving landscape of digital tokens to secure their investments?

The answer lies in understanding the intricacies of tokenomics analysis.

Tokenomics encompasses the study of an asset’s supply, demand, distribution, and utility within its ecosystem.

For investors, understanding tokenomics is crucial not only for assessing the potential success of a project but also for minimizing risks involved in investing. In this article, we will break down the components of tokenomics,

discuss strategies for investors, and provide insights into how specific factors influence valuation and sustainability.

What is Tokenomics?

At its core, tokenomics is the economic model of a cryptocurrency. It combines the principles of economics, supply chain management,

and technology to create a framework that governs a token’s functionality in its network. The importance of these economic mechanisms cannot be overstated; they determine how tokens are issued, distributed, and utilized.

In simple terms, think of tokenomics like the rules of a game: understanding these rules can significantly determine your success or failure in the investment landscape.

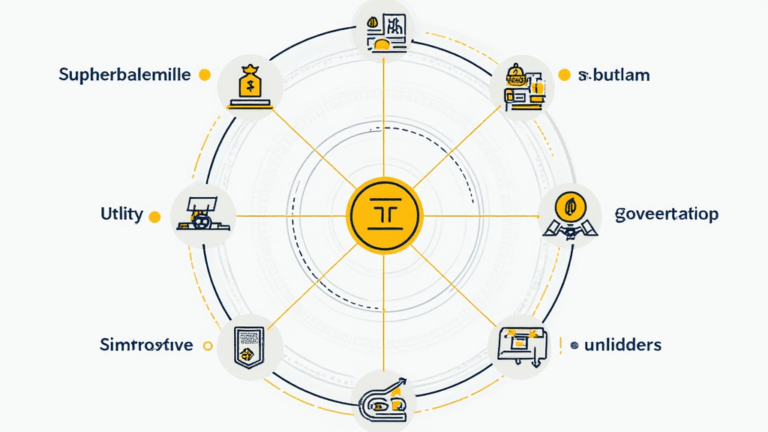

Key Components of Tokenomics

- Supply Mechanisms: The total supply, circulating supply, and inflation rate of a token can have a direct impact on its price.

A limited supply often creates scarcity, driving up demand and price. - Distribution Models: How tokens are distributed to investors, stakeholders, and the team can impact the token’s value.

Fair distribution mechanisms often foster community trust and growth. - Utility: Tokens with real use cases, such as transaction fees, staking, or governance, tend to perform better.

The more utility a token has, the more likely investors will demand it. - Governance Structure: Projects that allow token holders a voice in decision-making tend to create an engaged community,

while ensuring true decentralization. - Incentive Models: Properly designed incentive systems can promote user engagement and retention, further stabilizing the ecosystem.

Understanding Token Supply Dynamics

Supply dynamics play a pivotal role in determining a token’s value, similar to how traditional equities react to supply and demand factors.

For instance, consider Bitcoin, which has a maximum supply of 21 million tokens. This scarcity contributes

to its value; as adoption grows, the limited supply drives demand upwards.

Investors must pay attention to the following factors:

- Total Supply: The maximum number of tokens that will ever exist. Limited supply can create a sense of urgency among investors.

- Circulating Supply: The number of tokens currently available in the market for purchase or trade.

- Inflation Rate: The rate at which new tokens are created can affect value. Tokens with a high inflation rate may see declining value over time.

Distribution Models: Who Gets What?

Distribution methods can significantly influence a token’s long-term sustainability and success. We often see different models sponsored by projects. It’s essential to grasp how these distributions work.

- **Airdrops**: Often used for marketing, airdrops distribute tokens for free, increasing awareness and user base.

- **ICO and IEO**: Initial Coin Offerings and Initial Exchange Offerings often allow early investors the chance to buy tokens at a lower price before public distribution.

- **Staking Rewards**: Some projects offer rewards to users who stake their tokens, helping to ensure network security.

Understanding distribution can help investors anticipate a token’s future and gauge community engagement. If a significant percentage is distributed to insiders, for instance, it might indicate concentration risk and potential price volatility.

Exploring Utility and Its Impact

Utility is a vital aspect of a token’s success. Tokens explicitly designed for use within a platform’s ecosystem often enjoy robust demand.

- **Transactional Uses**: Tokens that serve as a digital currency in a platform will likely hold value as users transact within that ecosystem.

- **Governance Participation**: Tokens that grant holders voting rights on platform transitions tend to engage users and enhance community involvement.

- **Access to Features**: Some tokens allow access to unique features or products, thereby creating user dependency on the token.

For investors focused on long-term value, looking at the utility of a token can provide insight into its growth potential. A prime example includes Ethereum, where ETH serves as gas for transactions, making it essential for decentralized applications (dApps).

Governance and Community Engagement

Governance models shape investor and user participation. Tokens that empower users to make decisions foster a strong community and can be more attractive to investors.

- **Decentralized Governance Models**: Tokens enabling vote-based governance often create a vested interest among holders.

- **Involvement in Protocol Changes**: Engaged token holders can vote on proposing and implementing changes to their protocol, ensuring alignment between project goals and community needs.

When considering governance, assess whether token holders can influence the direction of the protocol and how these effects correlate with long-term value.

Incentive Structures: Keeping Users Engaged

Incentive structures can also play a significant role in tokenomics. Well-designed incentives encourage user engagement, enhancing the platform’s ecosystem.

- **Token Buybacks**: Some projects employ buyback strategies to reduce circulating supply, aiming to elevate token value over time.

- **Staking Rewards**: By offering financial rewards for holding tokens, projects encourage engagement and keep tokens off exchanges.

- **Referral Programs**: Incentivizing users to bring new participants into the ecosystem expands the user base.

Keeping these incentives front and center can strengthen investor confidence in a project. Engaged users generally lead to an increase in demand, which compounds the value of the token.

Tokenomics in the Global Market Context

With the rapid growth of cryptocurrency markets globally, understanding tokenomics has gained increasing importance among investors,

especially those considering opportunities in emerging markets like Vietnam.

According to recent reports, Vietnam has shown a significant increase in cryptocurrency adoption with a growth rate of approximately 51% from 2020 to 2023.

Investors entering this market must consider local regulations, individual project tokenomics, and global crypto trends.

Additionally, it’s important to consider how political and economic dynamics in such regions affect token valuations. Adapting strategies tailored to local conditions while respecting global standards is key.

The Importance of Tokenomics Analysis for Investors

Understanding tokenomics allows investors to make more informed decisions.

With the potential risks involved in investing in cryptocurrencies, an analysis of relevant factors such as supply, distribution, utility, governance, and incentives leads to better judgment and reduces risk exposure.

While the allure of high returns in cryptocurrency investments is tempting, it is essential to grasp the nuances of tokenomics. As digital assets continue to evolve, investors who focus on these fundamental principles will emerge as more competent decision-makers, ensuring their investments are sound and secure.

Conclusion

In summary, a tokenomics analysis for investors involves understanding the core components that interact to influence a token’s value and sustainability. By thoroughly analyzing supply, utility, distribution, and governance, investors equip themselves with essential knowledge that can help them navigate the ever-changing crypto landscape. Given the sharp growth in regions like Vietnam, conducting this analysis provides a competitive edge to capitalize on emerging opportunities in the cryptocurrency market.

As always, remember that our insights are for educational purposes only. Consult with a qualified financial advisor familiar with your local regulations before making investment decisions. Happy investing!

For more detailed guidance, check out our resources at ccoinshop.