Introduction: Understanding Bitcoin Trends in Vietnam

As the cryptocurrency ecosystem continues to grow, Bitcoin stands out as a premier digital asset, with a staggering market capitalization exceeding $800 billion in early 2023. Vietnam’s cryptocurrency landscape is experiencing rapid growth, with a reported increase of 40% in user adoption over the last year alone, driven by increased access to information and trading platforms. For investors and enthusiasts alike, understanding Bitcoin chart analysis is vital in navigating this volatile market.

In this article, we’ll delve into Bitcoin chart analysis in Vietnam, examining core trends, pivotal market changes, and what they mean for future investment strategies. Additionally, we’ll explore long-tail keywords such as “how to audit smart contracts” and projections for “the most promising altcoins of 2025,” adding further context to the evolving narrative around Bitcoin and cryptocurrency in general.

1. Current Trends in Bitcoin Chart Analysis

To effectively understand Bitcoin chart analysis in Vietnam, it’s essential to grasp current trends that influence price movements. These trends are often tracked using various chart types, such as candlestick charts, line charts, and bar charts. Each format provides vital insights into market behavior.

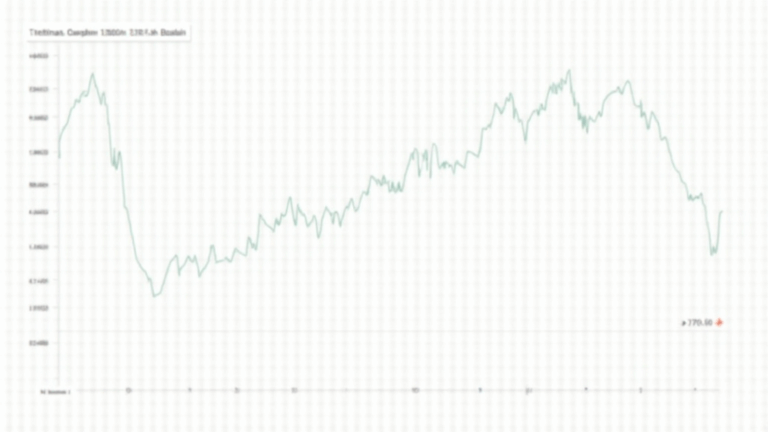

- Price Movements: The price of Bitcoin has experienced fluctuations from $30,000 to over $60,000 within the past year, showcasing significant volatility.

- Volume Analysis: A surge in trading volume often precedes price increases, indicating stronger investor interest.

- Technical Indicators: Key indicators like moving averages (MA) and Relative Strength Index (RSI) are commonly employed in chart analysis to predict future trends.

According to recent data from the Vietnam Cryptocurrency Association, the number of active traders in the country has reached approximately 1.5 million, making it a vibrant arena for Bitcoin trading.

2. Understanding Market Cycles

Market cycles in Bitcoin can be categorized into four phases: accumulation, markup, distribution, and markdown. Each phase represents distinct trading behaviors and investment opportunities. Recognizing these phases allows investors to tailor their strategies effectively.

- Accumulation Phase: Characterized by low prices and low trading volumes where early adopters begin to invest.

- Markup Phase: Investment increases lead to rising prices, attracting more traders and media attention.

- Distribution Phase: Prices reach a peak, and experienced traders start to sell off their holdings.

- Markdown Phase: Prices decline as interest wanes, typically following a period of exuberance in the markup phase.

This cyclical behavior highlights the importance of analytical tools and methods in Bitcoin chart analysis, which can help traders make informed decisions.

3. Key Technical Analysis Tools

Technical analysis forms the backbone of effective Bitcoin chart analysis. Here are some key tools utilized by expert traders in Vietnam:

- Moving Averages: The 50-day and 200-day moving averages provide insight into long-term trends and potential reversal points.

- Trend Lines: Drawing trend lines on price charts helps identify breakout levels and potential support or resistance areas.

- Fibonacci Retracement Levels: This tool helps traders pinpoint potential price retracement levels during market corrections.

Using these tools, investors can formulate strategies that capitalize on market movements, enabling better trade decisions and enhanced profitability.

4. Key Considerations for Bitcoin Investors in Vietnam

As the cryptocurrency market evolves, so too does the framework for responsible investment. Here are essential considerations for Bitcoin investors in Vietnam:

- Market Research: Continuous education around market dynamics is crucial.

- Regulatory Compliance: Adhering to Vietnam’s cryptocurrency regulations ensures that investments are legitimate and protected.

- Security Practices: Utilizing secure wallets, like Ledger Nano X, can reduce the risk of hacks by up to 70%.

By prioritizing these considerations, investors can enhance their confidence and mitigate risks involved in Bitcoin trading.

5. Future Projections: Bitcoin and Beyond

Looking into the future, several factors are set to shape the trajectory of Bitcoin:

- Regulatory Developments: Changes in legislation may impact how cryptocurrencies are traded within Vietnam.

- Technological Innovations: Advances in blockchain technology could enhance Bitcoin’s scalability and usability.

- Market Sentiment: investor sentiment will likely affect Bitcoin prices; understanding public perception is essential.

For example, analysts project that Bitcoin may reach $100,000 by the end of 2025, contingent upon macroeconomic conditions and adoption rates. As Vietnam continues to embrace cryptocurrency, its market could play a pivotal role in this projected growth.

Conclusion: The Path Ahead for Bitcoin in Vietnam

As Bitcoin continues to evolve, informed investors will find opportunities within market dynamics through effective chart analysis and strategic decision-making. With the Vietnamese cryptocurrency market becoming more vibrant by the day, now is the right time to engage with these trends.

To summarize, Bitcoin chart analysis in Vietnam isn’t just a niche skill—it’s a necessity for anyone looking to invest wisely. Consider exploring platforms like ccoinshop for more insights and resources on navigating the cryptocurrency market. Remember, while there are no guarantees in investing, being knowledgeable and adopting best practices can significantly improve your chances of success.

Author: Dr. Quoc Nguyen – A cryptocurrency analyst and author of over 15 papers in blockchain technology, with extensive experience in auditing notable projects.