CBDC Development Vietnam Update: The Future of Digital Currency

In recent years, the rise of cryptocurrencies and blockchain technology has sent ripples through financial markets worldwide. Vietnam, in particular, has made significant strides in exploring Central Bank Digital Currencies (CBDCs). With the rapid evolution of the digital economy, this article delves into the latest updates on CBDC development in Vietnam, analyzing its potential impact on the local economy and the wider crypto space. Are you curious about what the future holds for CBDCs in Vietnam? Let’s break it down.

Understanding CBDCs: What Are They?

Before we dive deeper into Vietnam’s developments, let’s clarify what a Central Bank Digital Currency is. A CBDC is a digital form of fiat currency issued and regulated by a nation’s central bank. Unlike cryptocurrencies, CBDCs are centralized and provide the same level of stability as traditional currencies. They offer various benefits, including enhanced transaction efficiency, reduced costs, and improved financial inclusion.

Why CBDCs Matter for Emerging Markets like Vietnam

- Financial Inclusion: According to statistics, as of 2023, approximately 70% of Vietnamese adults did not have access to traditional banking services. CBDCs can bridge this gap, offering a secure and accessible payment option for the unbanked population.

- Cost-Effective Transactions: Traditional banking systems can be costly, with high transaction fees. CBDCs can reduce these costs significantly, making transactions smoother and more efficient.

- Combatting Fraud: With the rise in cybercrime, particularly in the digital finance sector, CBDCs can incorporate advanced security features such as blockchain technology and cryptographic protocols.

Vietnam’s Current Landscape in CBDC Development

Vietnam’s State Bank (SBV) has been proactive in its approach to CBDCs, exploring the potential benefits and challenges associated with their implementation. Initial pilot projects were launched in early 2023 as a part of the nation’s digital transformation agenda. According to the SBV, the pilot aims to evaluate how CBDCs can improve payment systems while also addressing important issues such as security and user adoption.

A Snapshot of Vietnam’s Digital Economy Growth

As of 2023, Vietnam’s digital economy is projected to reach $57 billion, reflecting a staggering year-on-year growth of approximately 16%. The boom in e-commerce and digital payment solutions has set a fertile ground for CBDC adoption. This growth is an indicator that the demand for secure, digital financial solutions is on the rise.

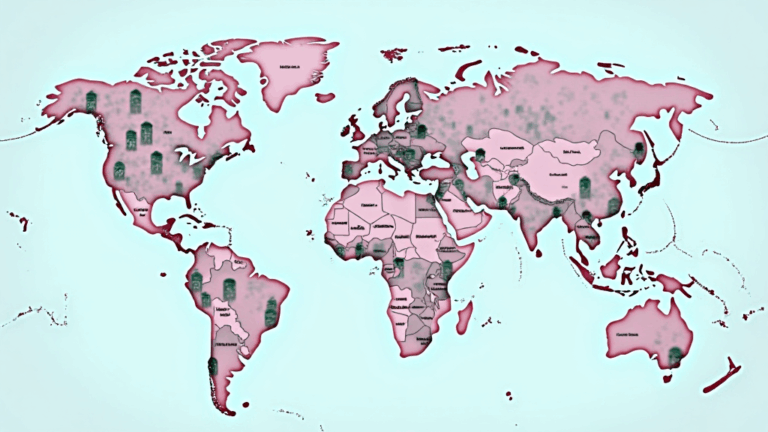

Learning from Global CBDC Implementations

Vietnam is not alone in exploring CBDCs. Countries like China, Sweden, and the Bahamas have already implemented various forms of digital currencies. By examining these cases, Vietnam can learn valuable lessons regarding user experience, regulatory frameworks, and technological infrastructure.

Case Study: China’s Digital Yuan

China’s Digital Yuan has gained significant traction, being integrated into everyday transactions. Its success lies in a robust regulatory framework and comprehensive public education campaigns. Vietnam can adopt similar strategies to enhance citizen engagement regarding the benefits and use cases of CBDCs.

Challenges Facing Vietnam’s CBDC Implementation

Despite the potential advantages, several challenges can hinder the wholesome adoption of CBDCs in Vietnam:

- Regulatory Concerns: Clear regulatory guidelines are essential to mitigate risks related to fraud and cyber-attacks.

- Technological Infrastructure: Developing the necessary infrastructure that can support a digital currency is crucial. Vietnam needs to invest in robust technology to ensure efficiency and security.

- Public Awareness: Without a thorough understanding of how CBDCs work, user adoption may be limited. Educational initiatives are required to facilitate understanding and acceptance.

The Road Ahead: Key Milestones for CBDC Development in Vietnam

Looking ahead, several key milestones can be anticipated for the further development of CBDCs in Vietnam:

- 2025 Roadmap: By 2025, Vietnam aims to have a fully functional CBDC system, with regulations and infrastructure in place.

- Public Engagement Initiatives: The SBV plans to launch nationwide campaigns to educate citizens about CBDCs and encourage adoption.

- International Collaborations: Collaborating with other nations exploring similar initiatives can provide Vietnam with valuable insights and best practices for success.

Conclusion: Embracing the Future of Digital Finance

The future of CBDC development in Vietnam looks promising, given the country’s rapid economic growth and the increasing prevalence of digital technology in day-to-day transactions. As we look toward 2025, the integration of a robust CBDC framework could revolutionize the financial landscape, enhance security, and promote financial inclusion for Vietnamese citizens. The time for Vietnam to embrace this digital revolution is now. As a final thought, remember that not all digital currencies are created equal, and citizens should remain informed to navigate this evolving landscape wisely.

For more insights and updates on CBDC development in Vietnam and the broader digital currency market, visit ccoinshop.

About the Author

Đức Nguyễn is a prominent digital finance expert with over 15 years of experience in blockchain technology and regulatory compliance. He has published more than 30 research papers in prominent journals and led audits for numerous well-known blockchain projects. Đức is dedicated to educating the Vietnamese public about the potential of digital currencies and their impact on the economy.